Need a Heat Pump Air Conditioner/Heater quote? Reach out for help!

Save Up To $0

Save Up To $0

The information provided on this site is for general informational purposes only and is not intended to be legal, financial, or tax advice.

Heat Pump Air Conditioner/Heater Incentive Details

Inflation Reduction Act Heat Pump Air Conditioner/Heater Rebate

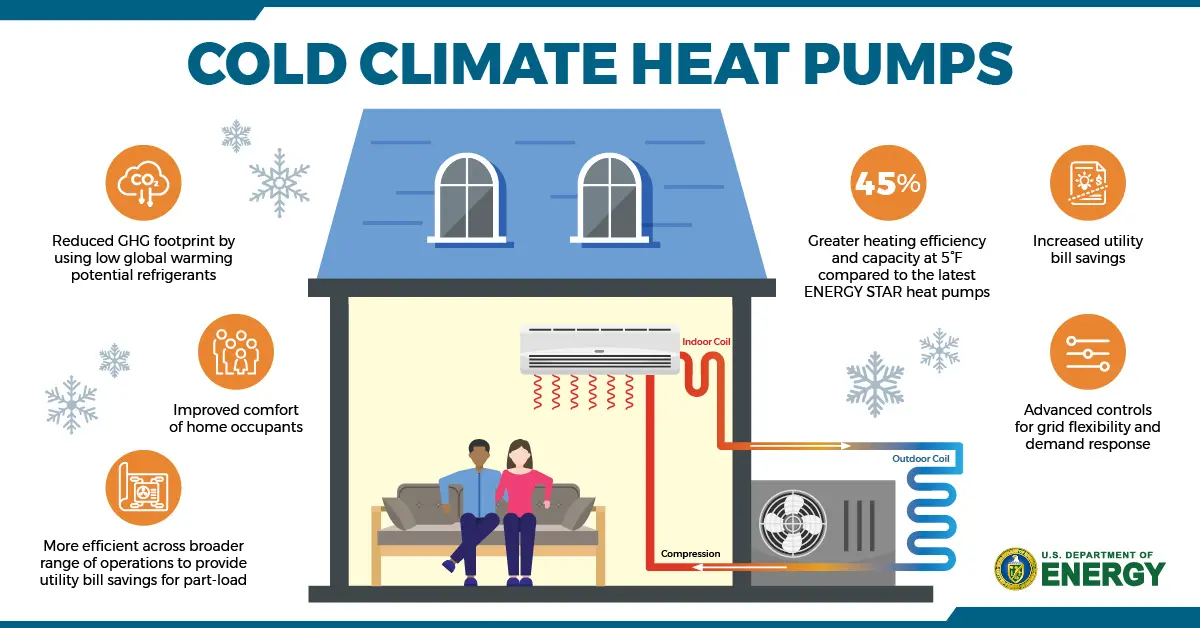

The Inflation Reduction Act includes a heat pump air conditioner/heater rebate program to encourage the adoption of energy-efficient and environmentally friendly heating and cooling systems. The details of the rebate program vary depending on the income level of the household:

- Low-Income Households (under 80 percent of Area Median Income):

- Electrification Rebates cover 100 percent of heat pump costs up to $8,000.

- This means that eligible low-income households can receive a rebate to cover the entire cost of purchasing and installing a heat pump up to $8,000.

- Moderate-Income Households (between 80 percent and 150 percent of Area Median Income):

- Electrification Rebates cover 50 percent of heat pump costs up to $8,000.

- This means that eligible moderate-income households can receive a rebate that covers 50 percent of the cost of purchasing and installing a heat pump, up to a maximum rebate amount of $8,000.

Tax Credits

The Inflation Reduction Act 25C is a tax credit program designed to incentivize residents in Connecticut to invest in energy-efficient heat pump air conditioners/heaters. Under this act, households can claim a 30 percent tax credit for the purchase and installation of heat pumps and heat pump water heaters. The credit is capped at $2,000 per year. The tax credit provided by 25C is reset every tax year, allowing households to claim the credit again for additional projects. This means that if a household installs multiple qualifying heat pumps or heat pump water heaters in different years, they can claim the tax credit for each installation.

In addition to the tax credit for heat pumps, 25C also includes a separate tax credit of 30 percent, up to $600, for upgrading the electrical panel. However, to be eligible for this credit, the electrical panel upgrade must be done in conjunction with another upgrade covered by 25C, such as the installation of a heat pump. Therefore, it might be advantageous for homeowners to consider both upgrades simultaneously to take advantage of the tax credit. Overall, the Inflation Reduction Act 25C aims to promote energy efficiency and the adoption of environmentally friendly heating and cooling systems by offering tax incentives to Connecticut residents who invest in heat pump air conditioners/heaters and related upgrades.

The Advantages

Upgrading to a heat pump air conditioner/heater in Connecticut offers several advantages:

- Energy Efficiency: Heat pumps are highly energy-efficient compared to traditional heating and cooling systems. They move heat from one place to another instead of generating it, resulting in significant energy savings. Heat pumps can be up to 3-5 times more efficient than fossil fuel heating systems, leading to lower utility bills and reduced energy consumption.

- Cost Savings: Due to their energy efficiency, heat pumps can save homeowners hundreds of dollars per year on heating and cooling costs. The savings can be even higher when fossil fuel prices rise. With proper usage and maintenance, heat pumps provide long-term cost savings for Connecticut residents.

- Environmental Friendliness: Heat pumps are electric appliances that do not burn fossil fuels directly. By using clean electricity sources such as solar power, heat pumps significantly reduce greenhouse gas emissions and contribute to a cleaner environment. They are a more sustainable and climate-friendly choice compared to systems that rely on fossil fuels.

- Dual Functionality: Heat pumps serve as both air conditioners and heaters, providing year-round comfort. They can efficiently cool your home during hot summer months and effectively heat it during colder seasons. This dual functionality eliminates the need for separate heating and cooling systems, saving space and simplifying home maintenance.

- Improved Indoor Air Quality: Heat pumps not only regulate temperature but also dehumidify and filter the air. They help maintain optimal humidity levels, reducing the growth of mold and mildew. Additionally, the air filtration feature removes airborne particles, allergens, and pollutants, leading to improved indoor air quality and a healthier living environment.

- Customizable and Connected: Modern heat pumps offer advanced features such as internet connectivity and variable-speed options. They can be controlled remotely through smartphones or other devices, allowing homeowners to adjust settings and temperature preferences conveniently. Some heat pump systems also enable room-by-room temperature customization, enhancing comfort and efficiency.

- Flexibility in Installation: Heat pumps come in ducted and ductless (mini-split) options. Ducted heat pumps utilize existing ductwork, making them suitable for homes with central HVAC systems. Ductless heat pumps, on the other hand, are ideal for homes without ducts or those looking for room-by-room zoning capabilities. Window-unit heat pumps are also available, providing flexibility for renters.

By upgrading to a heat pump air conditioner/heater in Connecticut, homeowners can enjoy energy savings, reduced carbon emissions, improved comfort, and enhanced indoor air quality. It is important to consult with professionals and consider eligibility for any available rebates or incentives to maximize the benefits of the upgrade.

Get Help Now

Costs & Savings

$8000 - $0

$10000 - $0

10 - 0

The average initial cost for a Heat Pump Air Conditioner/Heater in Connecticut will depend on several factors, including the size and complexity of your home, the type and model of the heat pump system, and any additional installation costs. On average, homeowners can expect to pay between $8,000 and $35,000 for a Heat Pump Air Conditioner/Heater system before incentives.

The lifetime savings for upgrading to a Heat Pump Air Conditioner/Heater will depend on several factors, including the size of your home, your current heating and cooling systems, and your energy usage habits. However, on average, homeowners can expect to save between $1,000 and $2,000 per year in energy costs by upgrading to a heat pump. Over the course of the system’s 10-15 year lifespan, this could result in savings of $10,000 to $30,000 or more.

Other Applicable Incentives

| Energize CT Rebate: $1250 per Ton | |

|---|---|

| Max Rebate | $15000 |

| Avg. Lifetime Savings | $15000 |

Claim up to $15,000 combined incentives for qualifying air source heat pumps. Energize CT heat pump rebates are based on equipment size (tonnage).

Install. Repair. Replace. Maintain. HCP Offers a Full Range of HVAC Services. HVAC Services

Heating

Learn More...

Air Conditioning

Learn More...

HVAC Rebates

Learn More...

Ductwork

Learn More...

Indoor Air Quality

Learn More...

A "Home Energy Solutions" Energy Audit is Your Best First Step.

Looking to maximize your Heat Pump Air Conditioner/Heater incentive/rebate and achieve optimal energy savings for your home? Look no further than a comprehensive Home Energy Solutions (H.E.S.) audit. By identifying areas of energy waste and recommending upgrades to enhance efficiency, a HES assessment is the logical first step in your energy savings journey. Plus, with the HES Score you receive, you'll be able to qualify for the best incentives available. Don't miss out on the opportunity to save energy and money - schedule your HES audit today and start your journey towards a more efficient home.

H.E.S. only costs you $75 out-of-pocket. It could be free-of charge if you qualify for Home Energy Solutions Income-Eligible (H.E.S.-IE).

$0

$0

Average Annual Energy Savings$0

Weatherization Service Value$0

Average 1st Year SavingsInsulation

| Rebate: $1.70 per Square Foot | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $4000 |

| Avg. Lifespan (Years) | 20 - 50 |

Triple Pane Window

| Rebate: $100 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $10000 |

| Avg. Lifespan (Years) | 20 - 30 |

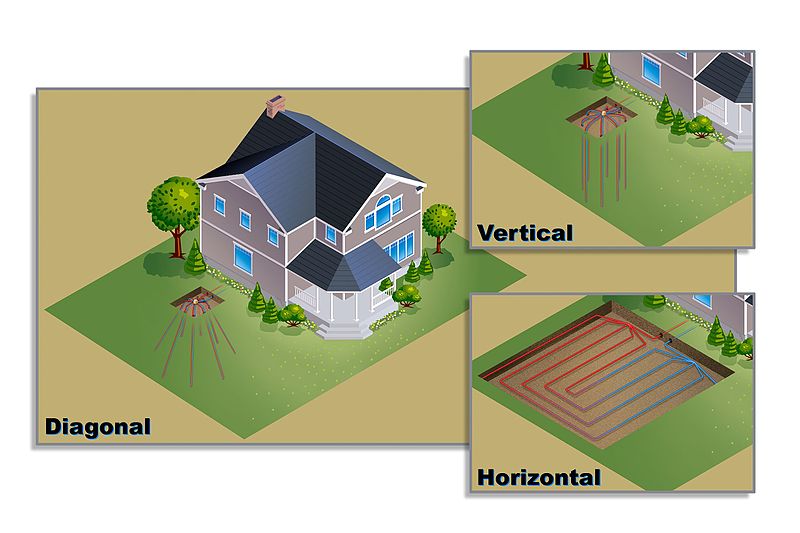

Ground Source Heat Pump

| Rebate: $1250 per Ton | |

|---|---|

| Max Rebate | $15000 |

| Avg. Lifetime Savings | $50000 |

| Avg. Lifespan (Years) | 25 - 50 |

Smart Thermostat

| Rebate: $85 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $565 |

| Avg. Lifespan (Years) | 9 - 10 |

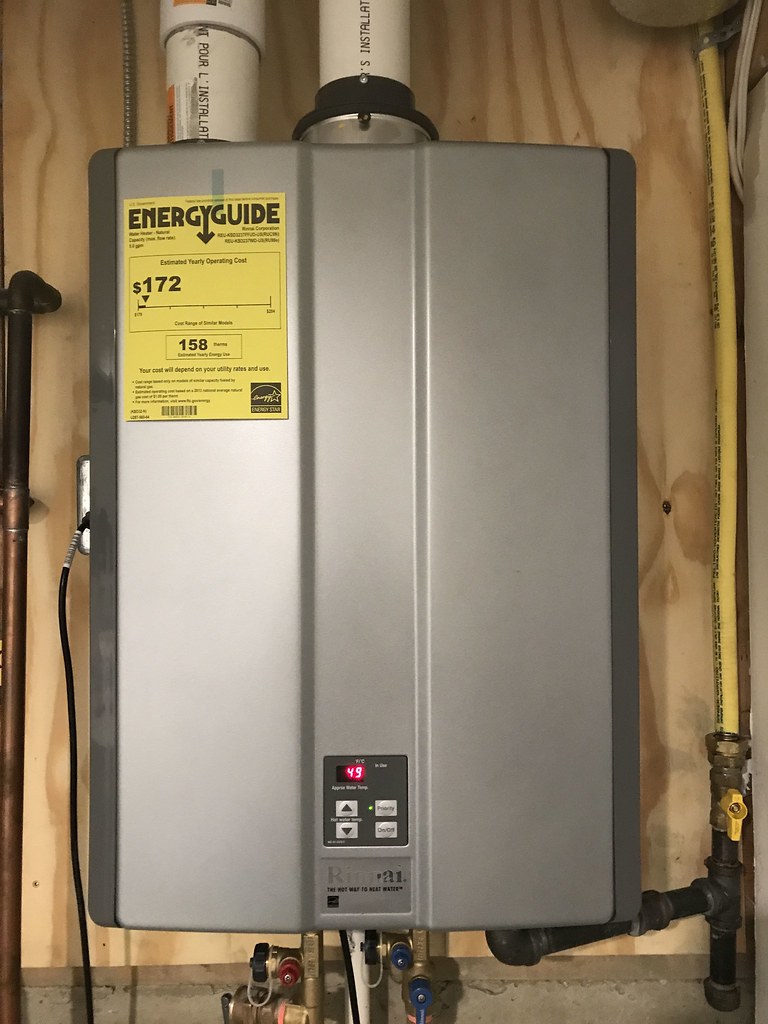

Tankless Gas Water Heater

| Rebate: $300 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $2000 |

| Avg. Lifespan (Years) | 18 - 20 |

Natural Gas Furnace

| Rebate: $650 per Unit | |

|---|---|

| Max Rebate | $650 |

| Avg. Lifetime Savings | $1550 |

| Avg. Lifespan (Years) | 18 - 20 |

Natural Gas Boiler

| Rebate: $750 per Unit | |

|---|---|

| Max Rebate | $750 |

| Avg. Lifetime Savings | $20000 |

| Avg. Lifespan (Years) | 18 - 20 |

Heat Pump Water Heater

| Rebate: $750 per Unit | |

|---|---|

| Max Rebate | $750 |

| Avg. Lifetime Savings | $4000 |

| Avg. Lifespan (Years) | 10 - 12 |

Gas Condensing Water Heater

| Rebate: $300 per Unit | |

|---|---|

| Max Rebate | $300 |

| Avg. Lifetime Savings | $1500 |

| Avg. Lifespan (Years) | 10 - 11 |

Boiler Circulator Pump

| Rebate: $35 per Unit | |

|---|---|

| Max Rebate | $35 |

| Avg. Lifetime Savings | $4800 |

| Avg. Lifespan (Years) | 10 - 15 |

Air Source Heat Pump

| Rebate: $1250 per Ton | |

|---|---|

| Max Rebate | $15000 |

| Avg. Lifetime Savings | $15000 |

| Avg. Lifespan (Years) | 15 - 20 |