Need a Battery Storage quote? Reach out for help!

Save Up To 0%

The information provided on this site is for general informational purposes only and is not intended to be legal, financial, or tax advice.

Battery Storage Incentive Details

Tax Credits

Thanks to the Inflation Reduction Act, households in Connecticut can claim an uncapped 30% tax credit for installing a battery storage system under 25D. This means that when a household installs a battery storage system as part of their clean energy setup, they can claim a tax credit equal to 30 percent of the total cost of the battery storage installation. The tax credits are nonrefundable personal tax credits, which means that a taxpayer claiming these credits can only use them to decrease or eliminate their tax liability. If the taxpayer’s tax liability is less than the amount of the credit, they will only be able to claim the amount of the credit up to the amount of their tax liability. These credits cannot be used to generate a tax refund on their own, but they can be carried forward to future tax years if the full credit amount cannot be used in the current year. Additionally, the eligibility criteria for tax credits can change, so it’s always best to consult with a tax professional for the most up-to-date information.

The Advantages

There are several advantages of battery storage for homeowners in Connecticut, including:

- Resilience against power outages: Battery storage systems provide a backup power source during power outages, ensuring that critical home appliances such as refrigerators, lights, and medical equipment can continue to operate.

- Reduced electricity bills: Battery storage systems allow homeowners to store excess solar energy generated during the day and use it during peak hours when grid electricity is most expensive, thus reducing their electricity bills.

- Increased energy independence: By using battery storage systems in combination with solar panels, homeowners can become less dependent on the grid, reducing their reliance on traditional utility companies.

- Environmental benefits: Battery storage systems allow homeowners to use more clean and renewable energy, reducing their carbon footprint and contributing to a cleaner environment.

- Improved grid stability: By reducing peak demand on the grid, battery storage systems can help improve the overall stability and reliability of the electric grid, benefiting all electricity users.

Get Help Now

Costs & Savings

$16000 - $0

5 - 0

According to the information provided by EnergySage, the average initial cost of a storage system in Connecticut in 2023 is somewhere between $16,000 and $22,000 for a system size of 13 kWh, with an average gross price of $19,000. It’s important to note that the specific cost of a battery storage system (or solar + storage system) will depend on the size, quality of equipment, type of inverters, and storage capacity and chemistry of the battery.

A "Home Energy Solutions" Energy Audit is Your Best First Step.

Looking to maximize your Battery Storage incentive/rebate and achieve optimal energy savings for your home? Look no further than a comprehensive Home Energy Solutions (H.E.S.) audit. By identifying areas of energy waste and recommending upgrades to enhance efficiency, a HES assessment is the logical first step in your energy savings journey. Plus, with the HES Score you receive, you'll be able to qualify for the best incentives available. Don't miss out on the opportunity to save energy and money - schedule your HES audit today and start your journey towards a more efficient home.

H.E.S. only costs you $75 out-of-pocket. It could be free-of charge if you qualify for Home Energy Solutions Income-Eligible (H.E.S.-IE).

$0

$0

Average Annual Energy Savings$0

Weatherization Service Value$0

Average 1st Year SavingsInsulation

| Rebate: $1.70 per Square Foot | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $4000 |

| Avg. Lifespan (Years) | 20 - 50 |

Triple Pane Window

| Rebate: $100 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $10000 |

| Avg. Lifespan (Years) | 20 - 30 |

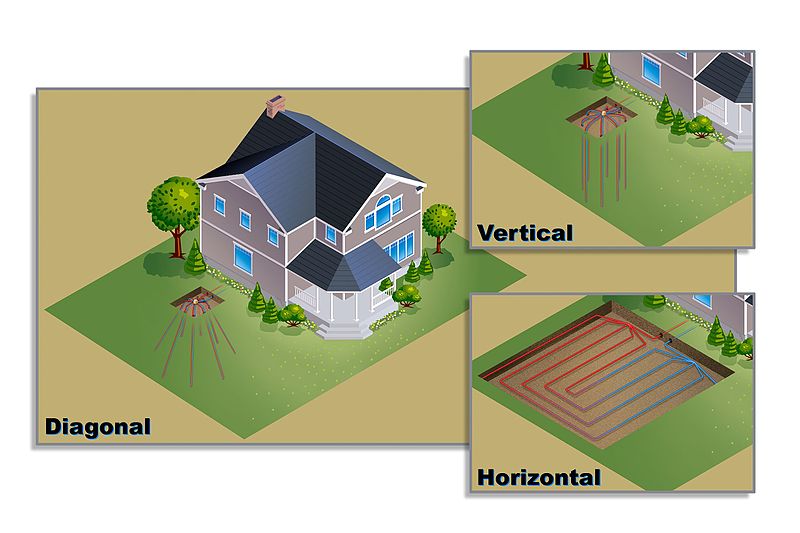

Ground Source Heat Pump

| Rebate: $1250 per Ton | |

|---|---|

| Max Rebate | $15000 |

| Avg. Lifetime Savings | $50000 |

| Avg. Lifespan (Years) | 25 - 50 |

Smart Thermostat

| Rebate: $85 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $565 |

| Avg. Lifespan (Years) | 9 - 10 |

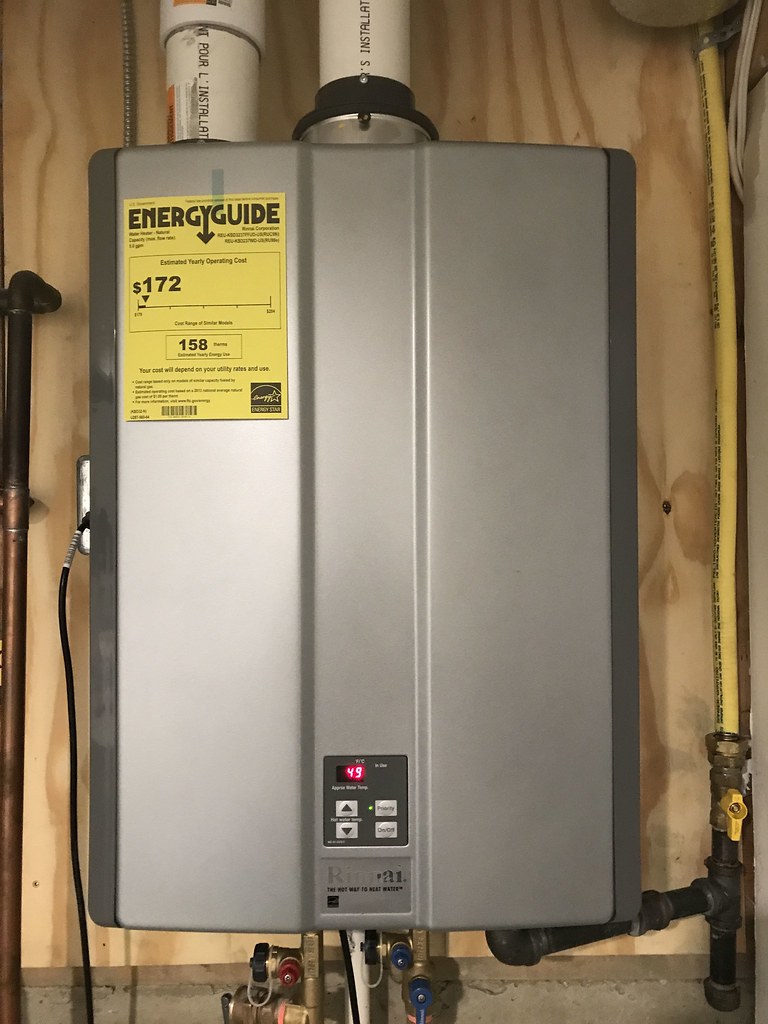

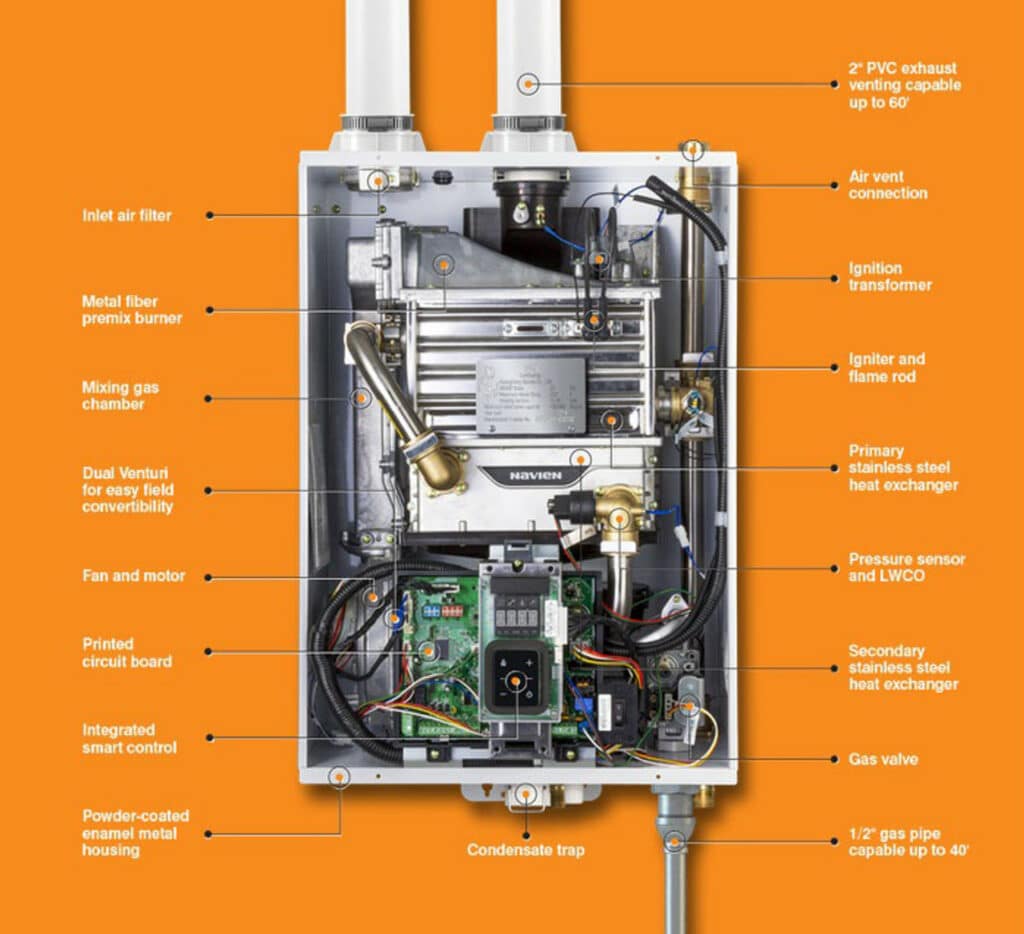

Tankless Gas Water Heater

| Rebate: $300 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $2000 |

| Avg. Lifespan (Years) | 18 - 20 |

Natural Gas Furnace

| Rebate: $650 per Unit | |

|---|---|

| Max Rebate | $650 |

| Avg. Lifetime Savings | $1550 |

| Avg. Lifespan (Years) | 18 - 20 |

Natural Gas Boiler

| Rebate: $750 per Unit | |

|---|---|

| Max Rebate | $750 |

| Avg. Lifetime Savings | $20000 |

| Avg. Lifespan (Years) | 18 - 20 |

Heat Pump Water Heater

| Rebate: $750 per Unit | |

|---|---|

| Max Rebate | $750 |

| Avg. Lifetime Savings | $4000 |

| Avg. Lifespan (Years) | 10 - 12 |

Gas Condensing Water Heater

| Rebate: $300 per Unit | |

|---|---|

| Max Rebate | $300 |

| Avg. Lifetime Savings | $1500 |

| Avg. Lifespan (Years) | 10 - 11 |

Boiler Circulator Pump

| Rebate: $35 per Unit | |

|---|---|

| Max Rebate | $35 |

| Avg. Lifetime Savings | $4800 |

| Avg. Lifespan (Years) | 10 - 15 |

Air Source Heat Pump

| Rebate: $1250 per Ton | |

|---|---|

| Max Rebate | $15000 |

| Avg. Lifetime Savings | $15000 |

| Avg. Lifespan (Years) | 15 - 20 |