Need a Rooftop Solar quote? Reach out for help!

Save Up To $0

Save Up To 0%

The information provided on this site is for general informational purposes only and is not intended to be legal, financial, or tax advice.

Rooftop Solar Incentive Details

Tax Credits

The Inflation Reduction Act’s 25D tax credit is a 30% non-refundable tax credit available to homeowners who install a rooftop solar system on their primary residence or second home. It can be used to offset any taxes owed, but cannot be used to receive a tax refund. The credit is available to those with adequate tax liability and can be combined with other funding on the national, state, and local level to reduce energy costs. In addition, 25D can be stacked with other rebates to further reduce the total costs of installation. However, the credit does not reduce upfront costs and renters may not be eligible for this specific tax credit.

The Advantages

Upgrading to rooftop solar in Connecticut provides several advantages for homeowners, including:

- Cost savings: Rooftop solar provides free, renewable electricity once it’s installed and paid for, potentially saving homeowners hundreds or even thousands of dollars in electricity costs over the lifespan of the system.

- Tax credits: Homeowners in Connecticut can claim an uncapped 30% tax credit on equipment and installation costs for rooftop solar through the federal 25D program, reducing the upfront cost of installing solar panels.

- Environmental benefits: Rooftop solar produces no carbon emissions, which helps to reduce the environmental impact of electricity production and combat climate change.

- Energy independence: Rooftop solar can provide homeowners with energy independence and protection against power outages, particularly when paired with home battery storage.

- Increased property value: Installing rooftop solar can increase the value of a home and make it more attractive to potential buyers, particularly in markets where renewable energy is in high demand.

Get Help Now

Costs & Savings

$10000 - $0

$11500 - $0

20 - 0

According to the Solar Energy Industries Association, the average cost of a 6 kW rooftop solar installation in Connecticut is around $15,300. By claiming the Inflation Reduction Act 30% tax credit on rooftop solar, the average tax credit will be around $4,600.

The lifetime savings of a rooftop solar installation can vary depending on several factors, including the size of the system, the amount of electricity used by the household, the local cost of electricity, and the cost of the solar panels and installation. According to EnergySage, the average homeowner in the United States can expect to save around $23,000 over the lifetime of a solar panel system, which typically lasts between 20 and 30 years. However, this number can be higher or lower depending on the specific circumstances of the homeowner. It’s important to note that savings will also depend on the maintenance and upkeep of the system over its lifetime, as well as any changes in local utility rates or incentives.

A "Home Energy Solutions" Energy Audit is Your Best First Step.

Looking to maximize your Rooftop Solar incentive/rebate and achieve optimal energy savings for your home? Look no further than a comprehensive Home Energy Solutions (H.E.S.) audit. By identifying areas of energy waste and recommending upgrades to enhance efficiency, a HES assessment is the logical first step in your energy savings journey. Plus, with the HES Score you receive, you'll be able to qualify for the best incentives available. Don't miss out on the opportunity to save energy and money - schedule your HES audit today and start your journey towards a more efficient home.

H.E.S. only costs you $75 out-of-pocket. It could be free-of charge if you qualify for Home Energy Solutions Income-Eligible (H.E.S.-IE).

$0

$0

Average Annual Energy Savings$0

Weatherization Service Value$0

Average 1st Year SavingsInsulation

| Rebate: $1.70 per Square Foot | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $4000 |

| Avg. Lifespan (Years) | 20 - 50 |

Triple Pane Window

| Rebate: $100 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $10000 |

| Avg. Lifespan (Years) | 20 - 30 |

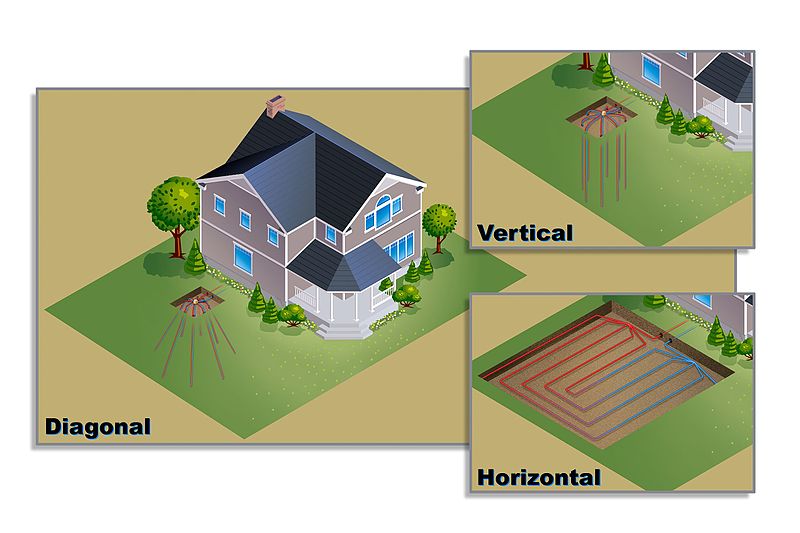

Ground Source Heat Pump

| Rebate: $1250 per Ton | |

|---|---|

| Max Rebate | $15000 |

| Avg. Lifetime Savings | $50000 |

| Avg. Lifespan (Years) | 25 - 50 |

Smart Thermostat

| Rebate: $85 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $565 |

| Avg. Lifespan (Years) | 9 - 10 |

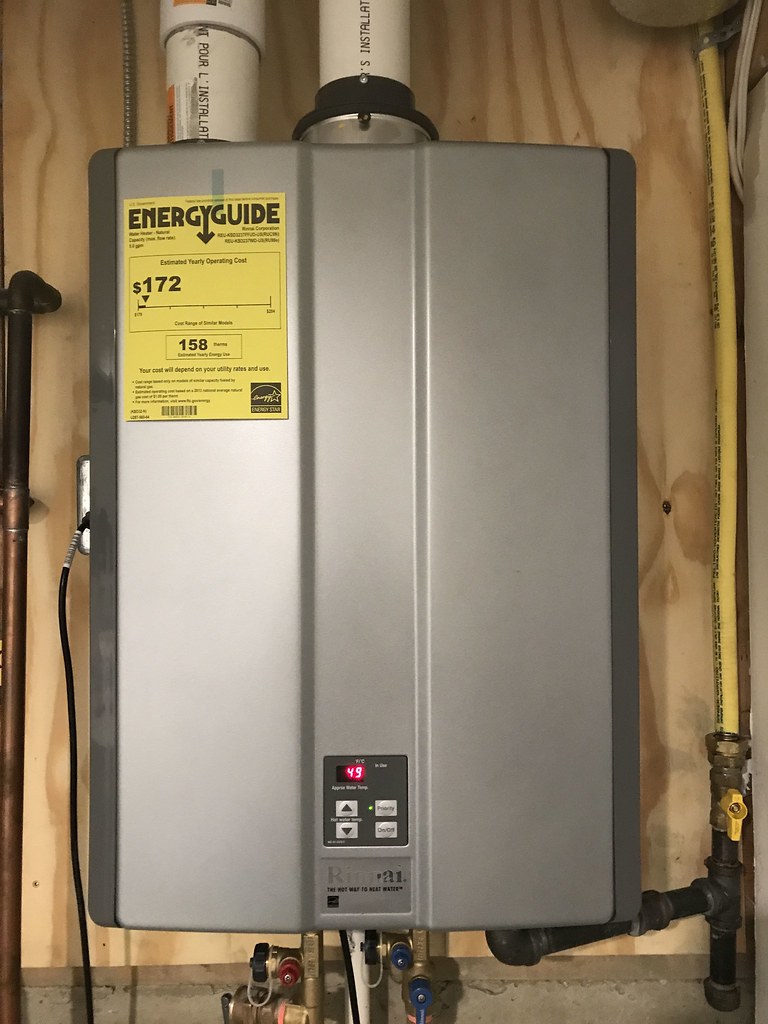

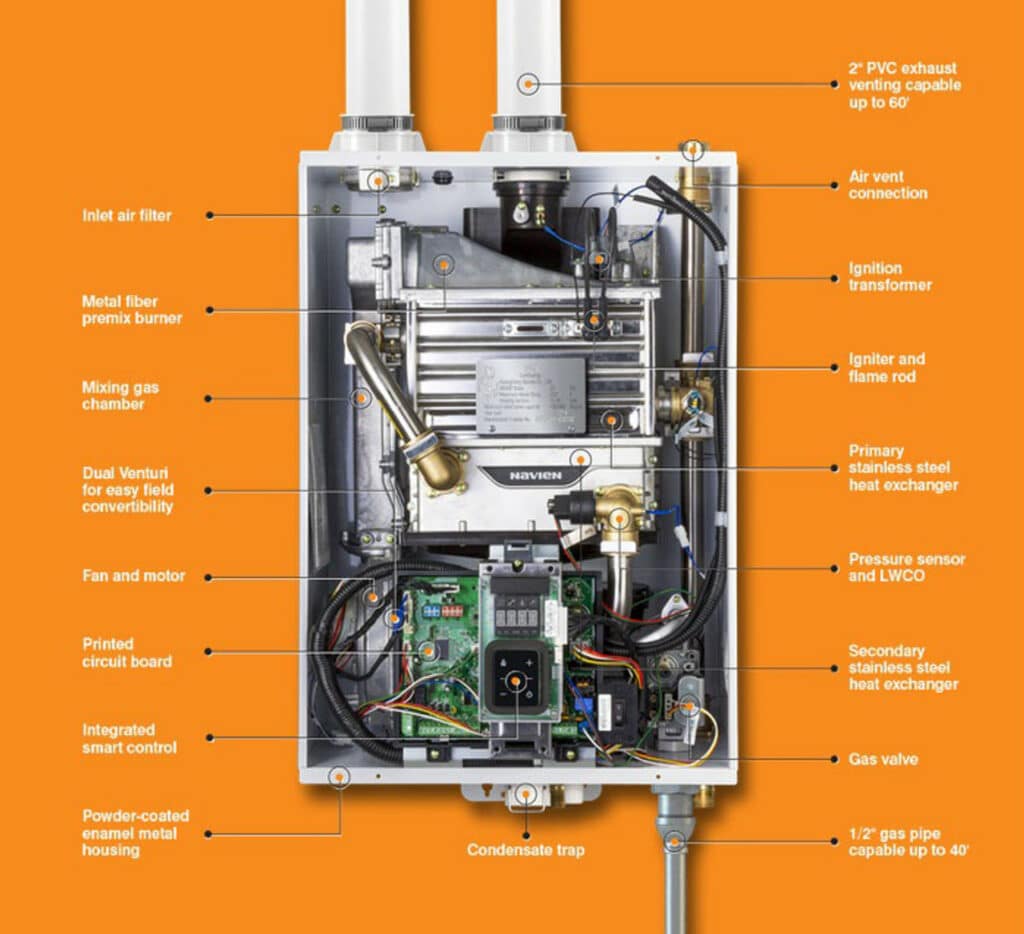

Tankless Gas Water Heater

| Rebate: $300 per Unit | |

|---|---|

| Max Rebate | N/A |

| Avg. Lifetime Savings | $2000 |

| Avg. Lifespan (Years) | 18 - 20 |

Natural Gas Furnace

| Rebate: $650 per Unit | |

|---|---|

| Max Rebate | $650 |

| Avg. Lifetime Savings | $1550 |

| Avg. Lifespan (Years) | 18 - 20 |

Natural Gas Boiler

| Rebate: $750 per Unit | |

|---|---|

| Max Rebate | $750 |

| Avg. Lifetime Savings | $20000 |

| Avg. Lifespan (Years) | 18 - 20 |

Heat Pump Water Heater

| Rebate: $750 per Unit | |

|---|---|

| Max Rebate | $750 |

| Avg. Lifetime Savings | $4000 |

| Avg. Lifespan (Years) | 10 - 12 |

Gas Condensing Water Heater

| Rebate: $300 per Unit | |

|---|---|

| Max Rebate | $300 |

| Avg. Lifetime Savings | $1500 |

| Avg. Lifespan (Years) | 10 - 11 |

Boiler Circulator Pump

| Rebate: $35 per Unit | |

|---|---|

| Max Rebate | $35 |

| Avg. Lifetime Savings | $4800 |

| Avg. Lifespan (Years) | 10 - 15 |

Air Source Heat Pump

| Rebate: $1250 per Ton | |

|---|---|

| Max Rebate | $15000 |

| Avg. Lifetime Savings | $15000 |

| Avg. Lifespan (Years) | 15 - 20 |